(An audio version of this letter can now be found as Episode 11 of The Unlimited Podcast by Ginsler Wealth. Use the link provided or find us on your favourite podcast app.)

To Ginsler Wealth’s Clients:

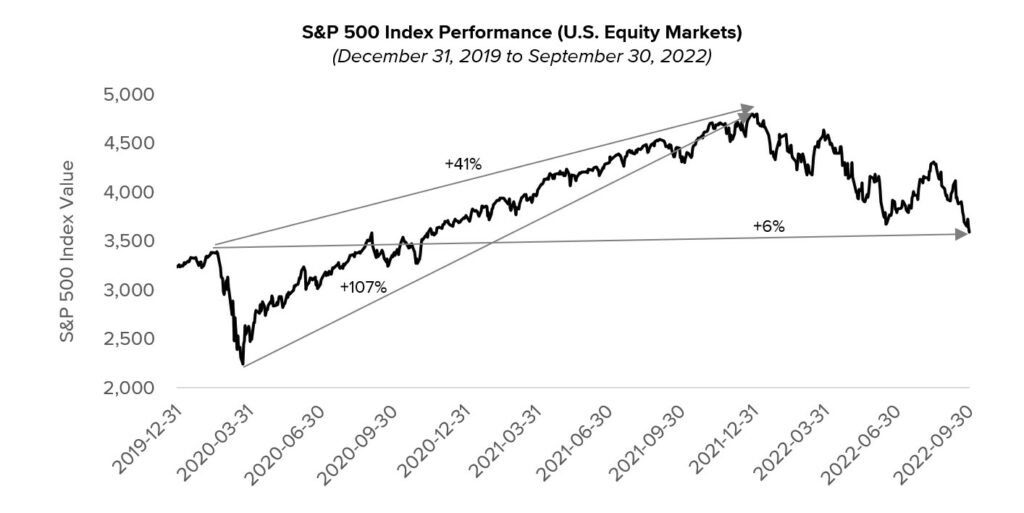

The economic and investment climate remained very challenging in Q3, following a very difficult first half of the year. As at September 30, 2022, the U.S. equity markets (as measured by the S&P 500) are just 6% above where they were in February 2020, just prior to the pandemic, after having risen 41% above the February 2020 peak and 107% from the March 2020 lows.

The Canadian equity markets (as measured by the S&P/TSX index) are just 3% above February 2020 levels after having risen 23% above the February 2020 peak and 97% from the March 2020 lows.

Canadian bonds (as measured by the S&P Canada Aggregate Bond Index) are down almost 11% this year. Central banks continue to raise interest rates to fight high inflation and Russia continues its war with Ukraine. It is reasonably likely that all the equity market gains made from the time Covid-19 began will be erased. Two and a half years…gone. So, what does this mean?

OPPORTUNITY KNOCKS

While it is easy to focus on the negative, we are focusing on opportunities this environment presents. For GW, this means taking the following actions:

- Looking at historic trends, especially equity market returns

- Adjusting your portfolio and/or finding new strategies

- Putting cash to work (even if just to earn more than bank account interest)

- Taking time to plan

- Focusing on your health

Looking at Historical Trends

While all client portfolios are tailored to your specific needs, goals, and objectives, in general, your investment portfolios with Ginsler Wealth include more than just traditional stocks and bonds. This diversification has helped insulate your assets from some of the challenges of this year.

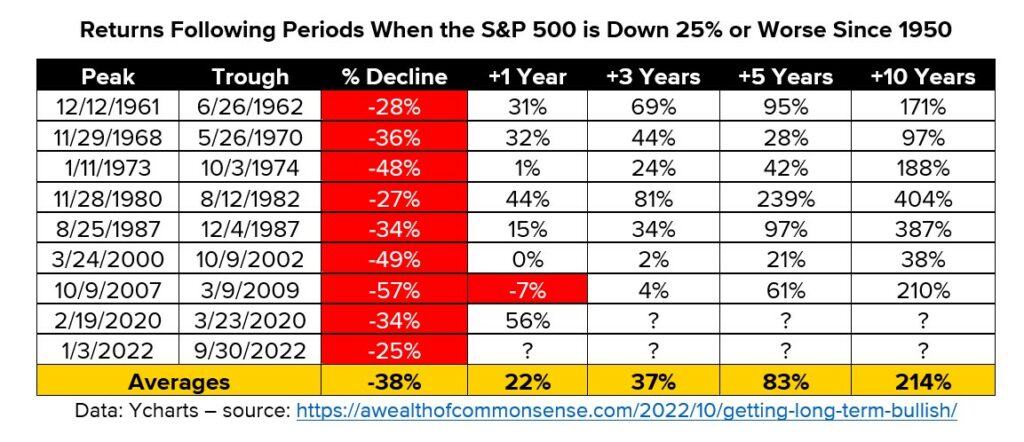

However, we still believe that over time, equities should be the highest return contributor to your overall portfolios. What does history say about equity returns following large declines? The table and chart below show that following declines of 25% or more, the S&P 500 (the barometer of the overall U.S. equity market) has historically gone on to post substantial gains.

As Ben Carlson says in the article where the above data was reported: “History provides no guarantees for the future, but I do find some level of comfort in knowing that buying stocks when they’re down big like this tends to offer positive outcomes.”

Adjusting the Portfolio and Finding New Strategies

While the data above should provide a level of optimism for equity returns going forward, I do note that the 2022 decline shown in the table above is also the smallest major decline. There certainly could be more pain in the short term. But the current environment has also created opportunities in other areas. These are just a few of the strategies we are either adding to or exploring on your behalf:

- Actively managed bond portfolios – as interest rates have risen, so too have yields on these portfolios – and we are confident that the managers we utilize are well aware of, and planning for, potential future interest rate increases,

- Agriculture, infrastructure, and other assets that could perform well in inflationary and/or recessionary environments,

- Structured Notes that provide dramatic downside protection along with the potential for high interest payments or magnified returns,

- Cash management opportunities – ways to earn a better return on cash that is sitting in your bank account (see next section).

In finding new strategies, we have spent a significant amount of time reviewing investment opportunities from existing and new managers, exchange-traded-fund providers, and even the banks (see Structured Notes above). We do not make investment decisions lightly. Our due diligence process is detailed, rigorous, and thorough.

For instance, we recently reviewed all the legal documentation (a few hundred pages!) for a U.S.-based fund that could be a good fit for certain client portfolios. In our review, we believed we had found one very important missing word, the missing needle in the haystack. After inquiring, we received the following (redacted) email back from the manager:

“Ginsler Wealth Team – It turns out you were quite correct, and our hilariously expensive NYC attorneys missed a very important word in the XXX clause.”

You rely on us to be thorough and thoughtful before investing your money. We take this responsibility very seriously.

Putting Cash to Work

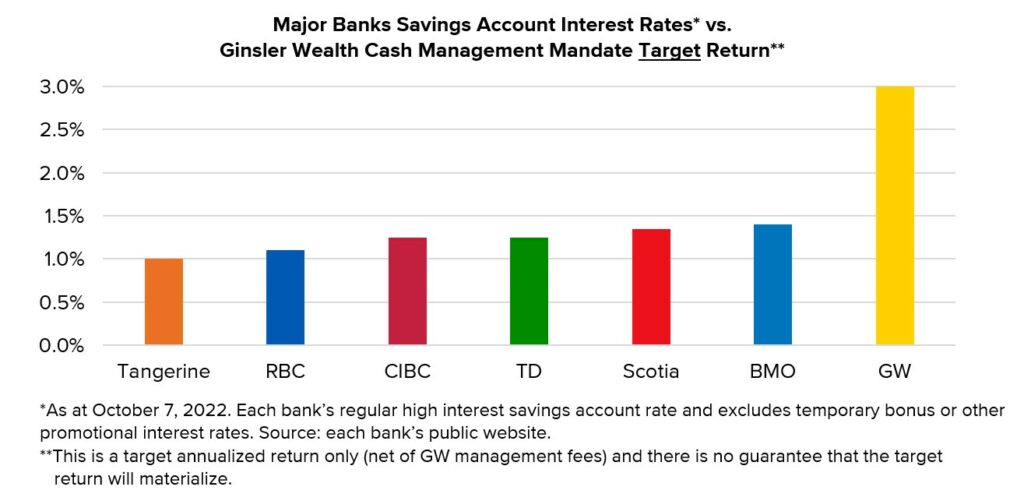

We know some investors are concerned about the current economic environment and have been sitting on cash in their bank accounts. This cash earns next to nothing and, net of inflation, its value is being eroded.

Due to demand from existing and new clients, we have compiled a selection of lower-risk, shorter-term “Cash+” strategies that we believe could provide a higher and potentially more tax-efficient return on dormant cash. The chart below provides a comparison of bank high interest savings account rates versus the target return on the Ginsler Wealth cash management mandate.

We believe a reasonable portion of the target return above should come in the form of capital gains which are taxed at half the rate of interest income. As a result, the net differential return after taxes, relative to the bank savings accounts, should be even higher than illustrated in the chart above.

While high and rising interest rates are bad for borrowers, they are beneficial to savers.

Taking Time to Plan

When investment gains are challenged, it is a reminder that keeping every dollar is even more important. On the planning side, we have been working with several clients to introduce more tax effective trust and corporate structures. This planning can serve to potentially minimize taxes over time and/or at the time of a business sale, while also protecting the owners of the assets from lawsuits and/or creditors. Doing this structuring work today, could lead to perpetual, risk-free returns in the form of ongoing tax savings.

We are also (continuously) seeking opportunities to harvest investment losses to be used in the future to offset capital gains. While no one enjoys crystallizing losses, when other opportunities present themselves (see above), switching out of current losers can lead to tax savings on future winners.

Focusing on Your Health

Finally, while finances and investments are what we do and are important, we aim to be helpful in many aspects of your lives. It is often said that “health is wealth” and we totally agree with this sentiment. As such, through a new relationship with Medcan, Ginsler Wealth clients can now enjoy a 15% discount on Medcan’s flagship Comprehensive Health Assessment, along with three other advanced health tests. Please contact us if you want to take advantage of this. We are also exploring partnerships with other health organizations with the goal of bringing more value to you in the future.

Finally, while finances and investments are what we do and are important, we aim to be helpful in many aspects of your lives. It is often said that “health is wealth” and we totally agree with this sentiment. As such, through a new relationship with Medcan, Ginsler Wealth clients can now enjoy a 15% discount on Medcan’s flagship Comprehensive Health Assessment, along with three other advanced health tests. Please contact us if you want to take advantage of this. We are also exploring partnerships with other health organizations with the goal of bringing more value to you in the future.

During the past quarter, we also recorded an Unlimited Podcast episode about the state of mental healthcare in Canada with Dr. Juveria Zaheer and Sandi Treliving, both involved with Toronto’s Centre for Addiction and Mental Health (CAMH). Mental health is an equally important component of your overall health, and we hope this podcast episode can help provide some insights into what you can do to help others or manage your own mental health.

CLOSING THOUGHTS

As we head into the final stretch of 2022, I don’t believe uncertainty or volatility will dissipate. Our role – on your behalf – is to seek out opportunities this challenging environment presents. I hope you can tell…we are on it.

Thank you for your trust, support, and confidence. We are available 24/7 should you need us.

Sincerely,

Brian Ginsler

President & CEO