(An audio version of this letter can now be found as Episode 37 of The Unlimited Podcast by Ginsler Wealth. Use the link provided or find us on your favourite podcast app.)

To Ginsler Wealth’s Clients:

You may have heard the joke about two economists walking down the street and seeing a $20 bill lying on the sidewalk. The first economist says, “Look at that $20 bill.” The second says, “That can’t really be a $20 bill lying there, because if it were, someone would have picked it up already.” So they walk on, leaving the $20 bill undisturbed.[i]

The notion above is that there can’t be “free money” lying around in plain sight. The “markets” are efficient and opportunities like the above cannot exist.

I beg to differ.

A few weeks ago, I was in a long line at Burger Shack, our family’s favourite burger joint, to pick up food for dinner. There were at least six people ahead of me placing and collecting their orders. As I waited for my turn to order, my eyes gazed at the floor directly in front of the cashier and I saw a loonie and a quarter lying in plain sight on the ground.

With that old economist joke in my head, I watched in disbelief as person after person completely missed, or ignored (?), the FREE MONEY lying on the ground.

When it was my turn to order, I promptly reached down and picked up the free money, and placed it in the tip jar for the staff.

Clearly, $1.25 is not a large sum of money, but if you can find $1.25 in many places, it can add up. At Ginsler Wealth, we believe a critical part of our job, is to find you “free money”.

THE SEARCH FOR FREE MONEY

Investing is hard. What I have learned in twenty-five years in the business is that you should jump at opportunities to earn a risk-free return (the investing equivalent of “free money”). As we oversee your finances and investments, here are examples of what we are doing, and have done, to seek out free money for your benefit.

- Tax and Investment Holding Structuring

The first step is to ensure your family has the appropriate tax structure in place to conduct your activities – with the goal of the highest after-tax investment and financial outcomes. For example, we have helped many of you set up holding companies and family trusts. These structures aim to either defer the payment of taxes or reduce a family’s overall tax burden. Similarly, simply making use of government-provided registered accounts (like the RRSP, TFSA, RESPs, etc.) can save a dramatic amount of taxes over time. In the case of the RESP[ii], the government literally gives you “free money” when you contribute. When you structure, or maximize the use of registered accounts, to defer or save taxes, the result is money you get to keep instead of handing it over to the CRA.

- Negotiating Fee Reductions

We are very conscious of the investment management fees you pay, and we strive to keep them as low as possible. Once we have determined that an investment strategy is a suitable addition to our roster, where possible, we go to work negotiating the fee structure (and sometimes other terms). Our investing scale often results in our clients paying a substantially discounted management fee. For example, with one of the strategies we use, the management fee is reduced by 0.75% for Ginsler Wealth clients. This equates to an additional “risk free” 0.75% return on this investment in your portfolio.[iii] This fee reduction has, on average, represented an annual 8% enhancement to the return on that investment over the past 3 years. We utilize several strategies with discounted fee structures to benefit our clients.

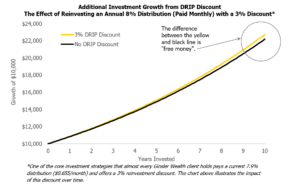

- Taking Advantage of Discounted Dividend Reinvestment Programs (“DRIPs”)

Similar to a fee reduction, we love finding investment funds than enable our clients to automatically reinvest monthly distributions at a discount to their market value. A number of the strategies we use offer a 2% or 3% reinvestment discount. This means that you earn an immediate, risk-free return on each distribution that is reinvested. Like the small change on the Burger Shack floor, it may not seem like a lot of money, but—as the chart below shows—if you can collect small amounts every month in perpetuity, they can add up.

In addition, certain strategies we use will pay distributions, not in the form of income (which is taxable), but rather as a “return of capital”[iv] (ROC) which are not taxable in the year received. Instead, the investor will incur a higher, but more favourably-taxed, capital gain at a later point when the holding is sold. This ROC acts as a tax deferral and tax reduction mechanism. Which leads us into the next item below…

- Re-characterizing Income into Dividends or Capital Gains

As you likely know, interest income is taxed at the highest rates in Canada. That is why, in addition to the prospect for high returns, investing in equities—whose returns come in the form of capital gains only when sold—tends to be the most tax-effective way to grow wealth inside a taxable investment account. But for those who wish to invest in other potentially less-volatile or less-risky asset classes for a portion of their portfolios, we have found a few select investment strategies that either pay dividends instead of interest, or have a legacy legal structure that enables all returns of any type to be treated as capital gains. The above strategies can potentially reduce your taxes between 25%-50% on each dollar of income. Put another way, a 5% return on the aforementioned tax-advantaged strategy would be equivalent to a regular bond portfolio that returns 8% in the form of income. While 8% sounds better than 5%, ultimately, the net return after taxes is the true measure of portfolio performance and our effectiveness as portfolio managers.

- The Use of Whole Life Insurance, Especially Inside a Corporation

Whole life insurance is a permanent insurance policy that grows in value over time by participating in distributions from the insurance company’s pool of investments. This type of policy offers a significant opportunity to boost wealth and estate value, for two key reasons:

- The policy’s value grows tax-free and is typically distributed tax-free[v] upon death, and

- When held within a corporation, the proceeds can be paid to your estate on a tax-free basis[vi] without being subject to additional taxes like most other corporate assets.

For someone with a corporation, the additional after-tax value of dollars invested in a whole life insurance policy can be potentially double what could be achieved without the use of insurance.[vii] Now that’s what I call “free money”!

For a deep dive into whole life insurance, along with a more concrete example of the above, please listen to the latest episode of The Unlimited Podcast—Insurance 201 with Sterling Park.

—————–

Why am I telling you about all this? First, we want to ensure you know what we are doing and how we are thinking around meeting your long-term wealth and investing goals. Second, we have always been clear that we don’t have a crystal ball and can’t predict the future. To mitigate this limitation (which we believe all investors and forecasters have, whether they admit it or not), we want to stack the deck in your favour by taking advantage of as much risk-free money and opportunities that we can find. This approach is akin to shifting the starting line of a race closer to the finish line.

Now, if only I could get that line at Burger Shack moving a bit more quickly!

THE ONLY THING “LIMITED” ABOUT YOUR GINSLER WEALTH EXPERIENCE…

Like most other businesses, Ginsler Wealth can be found on popular social media platforms including LinkedIn, Instagram, Facebook and X (formerly, Twitter). And of course, we have The Unlimited Podcast that is available to all as well. While we are active on those platforms, over the past few months I have realized that I have a lot I would like to share with our clients and closest “friends of the firm”, but not necessarily with our large number of public followers. And I wanted to do so in a way that would not bombard your email Inboxes.

So contrary to prevailing social media wisdom, we have created @ginslerwealthx, a private X account, to provide you with inside access to what we are thinking about and working on – on your behalf. Please note that while the account is private, once you follow it (and we let you in!), you will be able to see the other Followers and vice versa.

Think of it as the only thing “limited” about your Ginsler Wealth experience.

—————–

Finally, I would like to congratulate my colleague Safal Bhattarai—who many of you know well—on becoming registered by our Regulator, the Ontario Securities Commission, as a Portfolio Manager[viii], and as such his promotion to Portfolio Manager at Ginsler Wealth.

Thank you for your trust, support, and confidence. We are available 24/7 should you need us.

Sincerely,

Brian Ginsler

President & CEO

——————————

[i] Text taken from: https://www.cbsnews.com/news/efficient-market-thinking-is-inefficient/

[ii] Registered Education Savings Plan.

[iii] The additional 0.75% return is “risk free” because it is a direct subsidy by the manager and does not depend on the underlying performance of the investments themselves, which of course always carry some level of risk.

[iv] This return of capital (ROC) may be a full (i.e., 100%) or a partial return of capital, depending on the fund.

[v] The tax-free nature of whole life insurance may not be absolute under certain circumstances, including in shorter duration insurance policies. This letter is meant only to provide a high-level overview of the benefits of whole life insurance and is not comprehensive. Please speak with Ginsler Wealth Financial Services Inc., a FSRA licensed insurance agency, or your own insurance advisors for more specific details.

[vi] Ibid.

[vii] The precise outcome of utilizing these types of insurance policies will depend on the age, gender, and medical profile of the insured(s) at time of entering into the policy and the age of death of the unsured(s) amongst other factors. Talk to Ginsler Wealth Financial Services Inc. or you own insurance advisor for more precise details.

[viii] Technically, the registration category is called “Advising Representative” but is known in the industry as a “Portfolio Manager” registration.