(An audio version of this letter can now be found as Episode 32 of The Unlimited Podcast by Ginsler Wealth. Use the link provided or find us on your favourite podcast app.)

To Ginsler Wealth’s Clients:

My last quarterly letter was released on the evening of Friday, October 6. By the following morning, that letter couldn’t have been less important given the horrific atrocities occurring in Israel, and the resulting last 3 horrible months for Israel, Jews around the world, and innocent Palestinians – wholly and solely a result of Hamas’ atrocious attack on Israel and its citizens, and Hamas’ continued holding of hostages.

Because my last letter was just an evening too soon to address and discuss the above, I wanted to use this year-end letter to share a story about another Israel war, an Israeli tank commander, and how Israel and its soldiers conduct themselves.

1967: THE SIX DAY WAR

In June of 1967, Israel launched a pre-emptive strike on three of its neighbouring Arab states to counter what it perceived was an imminent threat from Egypt, Jordan, and Syria.

Egyptian forces were caught by surprise by Israeli airstrikes, and nearly all of Egypt’s military aerial assets were destroyed, giving Israel air supremacy. Simultaneously, the Israeli military launched a ground offensive into Egypt’s Sinai Peninsula. After some initial resistance, Egypt’s President Nasser ordered an evacuation of the Sinai Peninsula; by the sixth day of the conflict, Israel had occupied the entire Sinai Peninsula. (Israeli provisional control over the Sinai Peninsula ended in 1982 following the implementation of the 1979 Egypt-Israel peace treaty, which saw Israel return the region to Egypt in exchange for the latter’s recognition of Israel as a legitimate sovereign state.)[i]

Part of the ground offensive included the Armored Corps of the Israeli Defense Forces (IDF) – IDF’s tank division. During the Six Day War, Israeli Tank Commander Iacov Sucher led a battalion of tanks in the Sinai Peninsula. They were successful in defeating the Egyptian forces and had captured several Egyptian soldiers.

Part of the ground offensive included the Armored Corps of the Israeli Defense Forces (IDF) – IDF’s tank division. During the Six Day War, Israeli Tank Commander Iacov Sucher led a battalion of tanks in the Sinai Peninsula. They were successful in defeating the Egyptian forces and had captured several Egyptian soldiers.

With the heat of battle still raging, and sensing that tensions between his IDF troops and the captured Egyptian soldiers could easily escalate, Commander Sucher climbed to the top of his tank in full view of his troops and ordered that no Egyptian soldier shall be harmed from that moment forward; and any IDF soldier doing so would answer to him.

——————–

Six years later, during the Yom Kippur War, Commander Sucher would fight for Israel once again, this time in the Golan Heights.

——————–

Iacov got married, had two daughters in Israel and then immigrated to Canada, where he had a son. With his engineering degree from the Technion University in Tel Aviv, he eventually became certified as an engineer in Canada.

Almost 30 years after the Six Day War, Iacov went to pitch his engineering services to an architecture firm in Toronto. Upon seeing Iacov, the Egyptian-Canadian owner of the firm said to him, “I know you. Were you in Sinai in 1967?…You saved my life.”

——————–

Twenty years later, upon Iacov’s passing in 2017, during the shiva (the 7-day mourning period following a Jewish funeral) that same Egyptian-Canadian architect knocked on the door of my father-in-law Coby’s (nickname for Iacov) house to pay his respects for the man who saved his life…by doing the right thing.

Twenty years later, upon Iacov’s passing in 2017, during the shiva (the 7-day mourning period following a Jewish funeral) that same Egyptian-Canadian architect knocked on the door of my father-in-law Coby’s (nickname for Iacov) house to pay his respects for the man who saved his life…by doing the right thing.

This is how Coby protected his enemies’ lives during war, and how I believe the world needs to view the actions of Israel and its army today, which embraces life as opposed to terror and death – both then and now.

DO THE RIGHT THING

The work that we do managing your wealth is in no way comparable to Coby’s or any soldier’s actions during wartime. But Coby’s clear example of doing the right thing is applicable to every action we take. Ensuring we act in your best interest is our Guiding Principle, even if it means we don’t look good in the short-term, as illustrated by the example below.

Structured Notes in Your Portfolios

Over the past year – basically from the time interest rates started to rise dramatically – we have been investing on your behalf in securities called “structured notes”.[ii] I have previously written about these in my 2023 Q2 Letter, and 2022 Q3 Letter.

The specific type of structured notes we invest in are called Contingent Income Notes and they pay a high interest payment (e.g., 9-13%, with our client average being ~11%) as long as a certain “reference index” does not fall by more than 30% or 40% (the “Barrier Level”).

We will only buy structured notes where the reference index is an index of the Big Six Banks* or Canada’s large utility companies, as both indices tend to be reasonably stable and have a history of almost never falling below the above-noted Barrier Levels.

Based on almost 40 years of back-testing[iii] of historical returns of the Big Six Banks Index*, (as you can see in the chart below if you look very, very closely at the line along the bottom), the historic probability of missing out on coupon payments has been less than 4% over the life of the structured note. Similarly, based on the same data and history, the probability of losing money (i.e., any impairment of one’s principal investment) on this type of structured note held until it is called or until it matures, has been 0% (zero).

In short, in the current volatile economic and market environment, we are able to generate for you a high rate of interest with dramatic downside protection. But…because of how these structured notes are, well, structured, even though they will return to par over time, shortly after they are purchased they tend to trade below their purchase price. So, although you may be collecting the high income rate, those holdings almost immediately show a loss on your statements and drag down your reported short-term performance.

Put another way, we bought you a security that we know is likely to go down (temporarily), and we earn less in fees since our fees are based on the value of your accounts.

It would be easier for us to find something else to buy, or stick to only traditional asset classes, or heck, even just hold GICs! But that wouldn’t be doing the right thing. We are willing to show weaker performance and earn less fees in the short term to ensure your long-term investing success. This is because we are confident that these structured notes will deliver double-digit returns with dramatic downside protection[iv] – which is not easy to find these days!

JOMO AND FOMO

Speaking of short and long-term, the end of this calendar year may be a good time to re-assess your appetite for risk – by reviewing the short and (slightly) longer-term performance of the U.S. equity market.

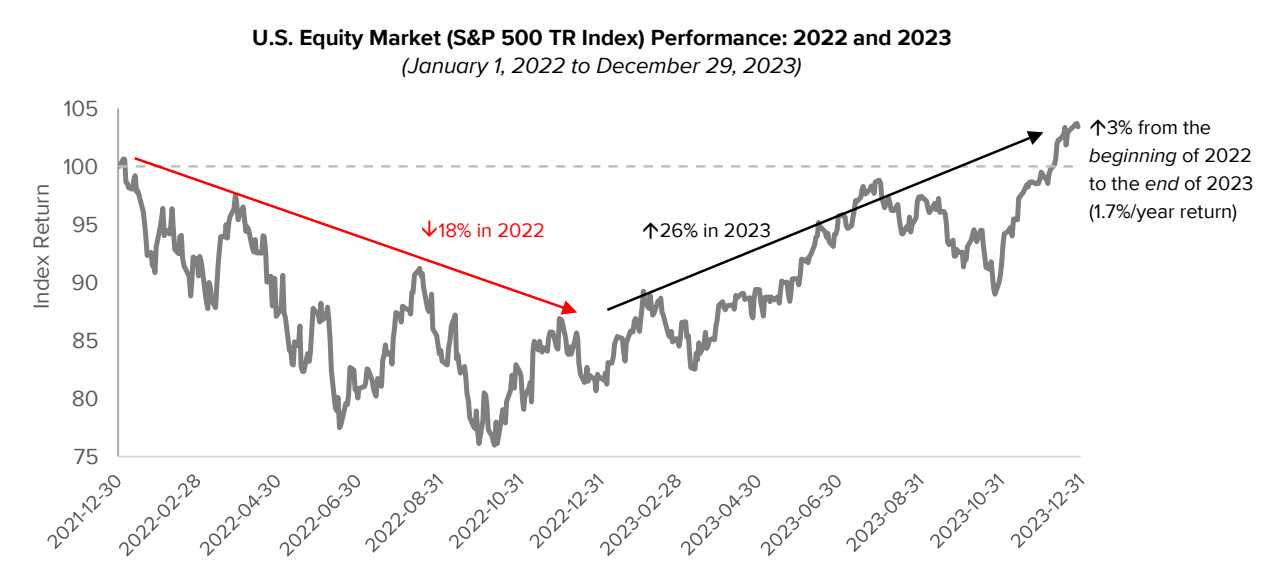

As you can see in the chart below, 2022 was a terrible year for U.S. equity investors with a volatile ride ending in a negative 18% return. Aside from continuing volatility, 2023 was precisely the opposite of 2022, primarily driven by the Big 7 technology stocks (as detailed in my last quarterly letter), with the S&P 500 Index up 26%. This means – for most investors who were invested in the U.S. market throughout 2022 and 2023, their annualized return was about 1.7%.

Ginsler Wealth clients likely experienced JOMO (Joy Of Missing Out) on dreadful equity performance[v] in 2022, but conversely, may have experienced some FOMO in 2023…missing out on the full upside of 2023’s equity performance, given the much more diversified portfolios clients tend to have here at Ginsler Wealth.

Going into 2023, we were concerned about the resilience of equities. That concern hasn’t abated as we enter 2024. We believe the right thing to do for you is tactically diversify across numerous asset classes and strategies to first, protect against losses, and second, to grow your wealth prudently.

If Coby taught me anything during my time spent with him, it is to always do the right thing. And now more than ever, it seems like we need more Cobys in this world.

Wishing you unlimited health, happiness, and peace in 2024. Thank you for your trust, support, and confidence. We are available 24/7 should you need us.

Sincerely,

Brian Ginsler

President & CEO

——————————

[i] General historic details sourced from Wikipedia and with the help of ChatGPT.

[ii] For the balance of this letter, please recall that our clients have different investment goals, objectives, and risk tolerances, and therefore will have different portfolios, (and different results), which may not include some of the strategies detailed herein.

[iii] Back-tested index data provided by Bank of Nova Scotia. November 2023. Historical results may not be indicative of future results.

[iv] See endnote (iii) above.

[v] See endnote (ii) above.